In a field as inventive as crypto, new phrases emerge at a rapid pace. GameFi, a concept that is challenging the traditional gaming industry, is gaining popularity. GameFi is a blockchain-based gaming commercialization platform that combines cryptocurrencies, DeFi, and a play-to-earn NFT crypto game model. Crypto gaming has changed the way games are played and, as a result, the game industry. Let us talk about How Does Gamefi Integrate Crypto, Defi, and ‘Play To Earn’ Gaming?

What Exactly Is GameFi?

DeFi is an abbreviation for decentralised finance, a sector in which token-based transactions like borrowing and lending happen on blockchains, which are decentralised digital ledgers initially utilised with Bitcoin. GameFi, in its most popular meaning, refers to decentralised applications (“dapps”) with cash rewards. These are often tokens awarded as prizes for completing game-related activities like winning battles, mining valuable materials, or cultivating digital crops.

Final Fantasy creator Square Enix recently stated that it may explore launching its own token.

It is a strategy known as “play-to-earn.” Many GameFi programs, including Alien Worlds, allow users to generate money passively by allowing others to mine their virtual territories. They may also earn money by using DeFi platform-developed procedures to lend commodities such as virtual characters or invest them in what is known as staking.

How Does GameFi Operate?

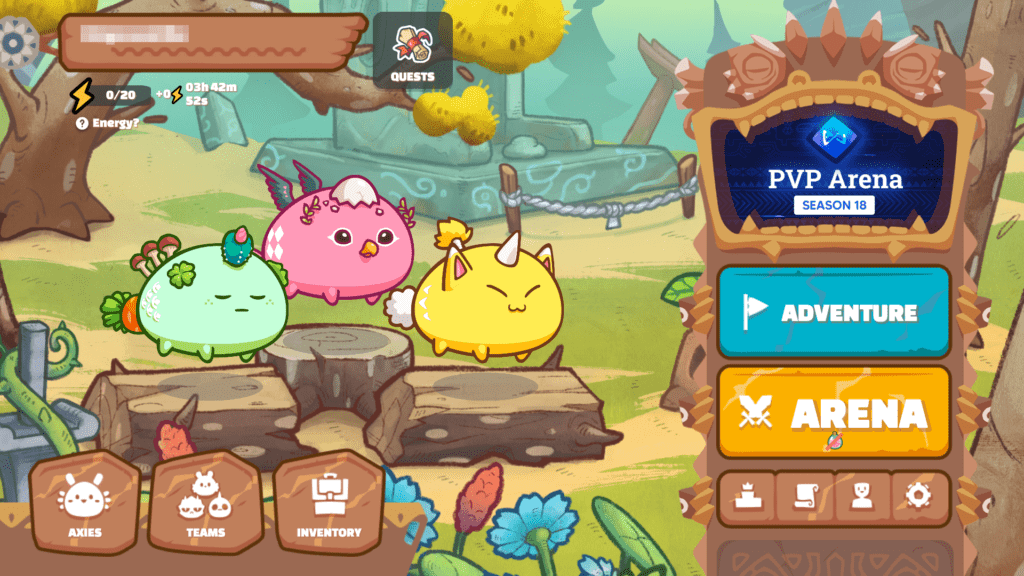

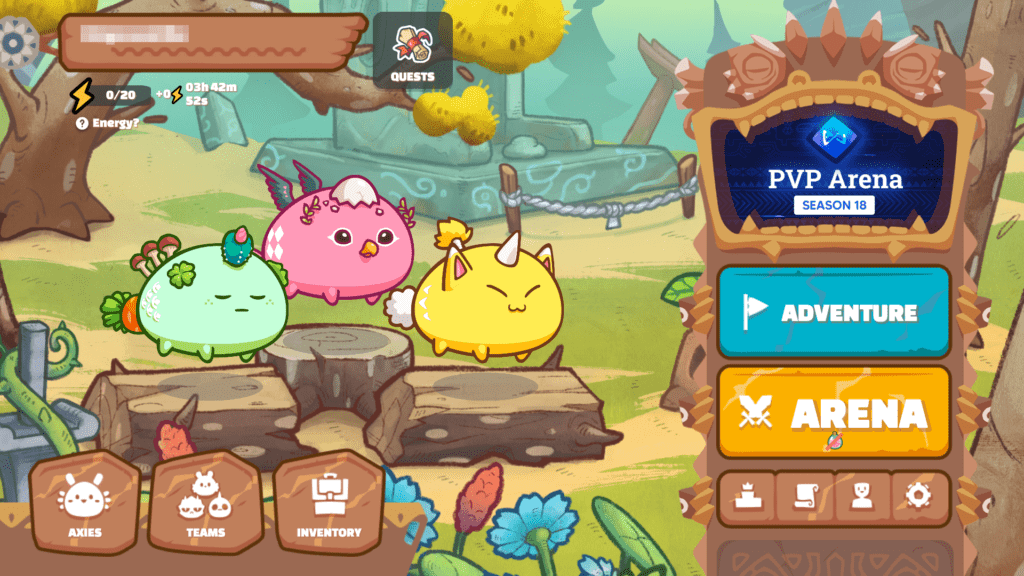

Details vary, but the most simple approach, launched in the failed game Axie Infinity, which had $564 million in on-chain transaction activity in the previous 30 days, according to DappRadar. Axie’s economy is based on two tokens, AXS and Smooth Love Potion (SLP), as well as non-fungible tokens (NFT), which are digital proofs of legitimacy that represent game characters and digital real estate.

Players often put in roughly $700 to purchase Axies, which are little blob-like monsters. They are compensated with SLP for winning fights and completing objectives. Axies may also breed and sell their progeny. AXS is a governance token that grants the opportunity to participate in conversations about it that. AXS tokens can be staked to generate income as well.

Why Did Axie Infinity Fail as a GameFi P2E Game?

Axie’s game wasn’t fun to play. Players were only playing to earn money. When the token price dropped players could no longer earn money easily, so they stopped playing. Axie prioritized the token model over fun gameplay. this mistake is a learning lesson to all game developers: the fundmantal value of a game is fun gameplay. This is evidenced in successful traditional games that earn revenue because gamers ejoy the gameplay. Game studios should therefore prioitze gameplay and build token models as a secondary consideration.

Is It Expensive To Play P2E Games?

Many are free however some require you to buy an asset (usually a game character) in order to get started. Most games give you the choice of playing for free (but it’s slow to progress) or buy assets (that will speed up your progress). In some cases, playing might be incredibly lucrative, but it’s important to remember there is no guarantee of income. Essentially, if you win tokens in a game that rises in popularity, those tokens might increase in value, possibly dramatically: AXS’s price increased from 54 cents to $94 in 2021. But the token price of AXS collapsed in 2022 and has not yet recovered. This implies that playing is more than just a game against digital dragons; it is also a type of money speculation. Whether or not that is a sustainable strategy, it was enough to draw players in low-income nations like the Philippines during Axie’s rise.

Tokens Have Always Existed In Video Games, Correct?

In almost all the virtual worlds there are in-game currencies. For example, Robux may be used to purchase virtual Gucci purses for avatars in Roblox, whereas V-Bucks can be used to purchase pickaxes in Fortnite Battle Royale. In Pokemon World, there is the Pokemon Dollar, which is reward money for winning battles and may be spent on potions and clothing. But that type of money and digital products are not always easy – or legal – to sell or turn into cash outside of games. The key point is that in-game currencies are often locked inside of one game. Historically it’s not easy to sell game assets outside of the game. GameFi is different because it actively promotes the fact that tokens can be sold for money outside the game.

Those who could not afford the game’s initial purchase price sometimes rented old Axies from previous gamers. In many situations, they compensated by dividing their gaming earnings. Last year, there was a stream of social media posts about individuals in the Philippines earning more profit through Axie than through typical day jobs – comments that, given the incentives for game makers and early players to hype up a game’s attractiveness, should be taken with a grain of salt.

What Is the Difference between GameFi Tokens vs Traditional Game Assets?

GameFi tokens are intended to function as full-fledged cryptocurrencies. This implies that gamers may transfer their in-game gains into cash on a variety of decentralised exchanges. GameFi coins are subject to the same volatility as other cryptocurrencies that are not tied to a traditional currency.

That implies that if demand rises, even small gains might skyrocket: the Metaverse Index, which analyses the value of tokens from 15 different gaming and entertainment projects, including Axie Infinity and Decentraland, has more than quadrupled since its introduction last April.

Of course, owning volatile assets may result in significant losses as well as gains, and players may find difficulty if they try to cash out during a major fall. Some tokens may also be utilised in a variety of DeFi apps, where they can generate interest by being used as collateral for loans, for example.

How Do Companies make money With GameFi ?

Game producers are typically paid in tokens, thus the more individuals that play the game and trade the coins, the more money they are making. Some games levy fees on specific transactions, with the proceeds going to affiliated corporations or treasuries, from which developers are paid.

Is GameFi Being Scrutinised By Regulators?

Yes, regulators have announced their investigation into Gamefi but they have been slow to give a verdict on any games. Regulators also haven’t provded clear legislation to guide gaming studios. Regulators are still catching up with earlier waves of crypto innovations at this time. They have previously expressed concern about the free-wheeling world of DeFi, and they may issue further rules this year. It is hardly a stretch to believe that games with DeFi-like elements will have to follow the same restrictions, and that this will happen sooner rather than later, if the popularity of Axie Infinity is any indication.

Many supporters view GameFi as a way for the little guy – the player – to break free from the grip of traditional game producers. Many players despise the businesses that create their games. Authorities are still attempting to catch up with prior rounds of crypto innovations. They already have indicated that they are concerned about the free-wheeling world of DeFi and may issue further restrictions this year. It is hardly a leap to believe that games with DeFi-like elements will have to follow the same restrictions – and probably relatively soon if the popularity of Axie Infinity is any indication.