How Goldfinch Transformed Real World Lending Using Web3

Why Care?

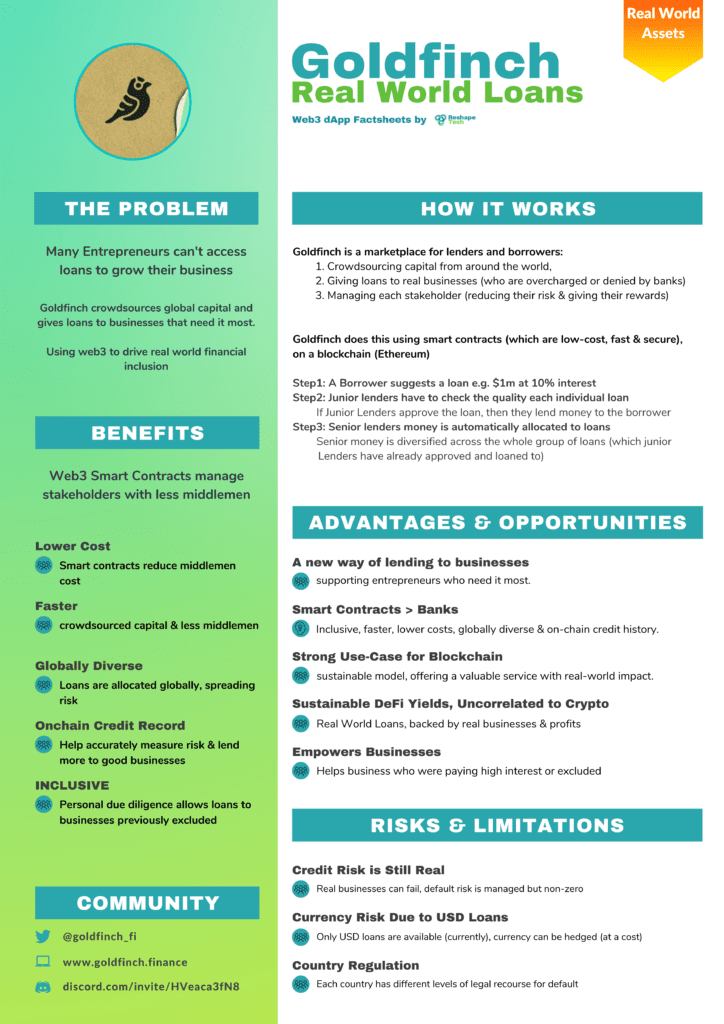

A new way of lending to businesses: supporting entrepreneurs who need it most.

Competing with banks: more inclusive, faster, lower admin costs, globally diverse & have on-chain credit history.

Strong use-case for blockchain: Goldfinch is a sustainable model, offering a valuable service with real-world impact.

Empowers businesses: who were previously excluded or ripped off by expensive loans.

Factsheet Summary

What Does Goldfinch Do?

Goldfinch is a marketplace for lenders and borrowers. This includes:

- Crowdsourcing capital from around the world,

- Giving loans globally, to real businesses (who are overcharged or denied by banks)

- Managing each stakeholder (reducing their risk & giving their rewards)

Goldfinch does this using smart contracts (which are low-cost, fast & secure), on a blockchain (Ethereum)

What Benefits Does Goldfinch Offer?

- Permanently improved Lending: inclusive, faster, low-cost, global & inclusive

- Real world usefulness: gives access to finance, in countries that need it most

- Sustainable DeFi’ yields: backed by real businesses & profits

- Efficiently Manage Risks & Incentives: using smart contracts

How Does Goldfinch Work?

Every loan has 3 stakeholders:

- A Borrower: receives the money

- Junior Lenders: get a high interest rate, but get repaid last

- Senior Lenders: get a low interest rate, but get repaid first

An example illustrates:

Step1: A Borrower suggests a loan e.g. $1m at 10% interest

Step2: Junior lenders have to check the quality each individual loan (due diligence: is the likely to be repaid?)

- If Junior Lenders approve the quality of the loan, then they lend money to the borrower

Step3: Senior lenders money is then automatically allocated across all loans

- Senior money is loaned across the whole group of loans (which junior Lenders have already approved and loaned to)

How Does Goldfinch Align All Stakeholders?

Goldfinch elegantly aligns stakeholders, using efficient smart contracts. Let’s dive into the most important questions for each stakeholder:

Borrowers

Why do Borrowers want a loan?

Traditional banks deny loans or charge too much interest

Why will Borrowers pay back the loan?

- Junior lenders can enforce a legal contract & tie their assets as collateral

- Borrowers have a permanent public credit record (recorded on a public blockchain)

- If borrowers delay repayments, they can’t get any new loans

Junior lenders

Why will Junior Lenders do a good job checking quality of the loan?

They get paid last, so they have the most to lose. This gives them a strong incentive to do a good job of checking that the loan is likely to be repaid

Why will Junior Lenders lend money when they get paid last?

Because they receive the highest interest rate (a much bigger reward than senior lenders)

Senior Lenders

Why will Senior Lenders lend money?

To get a competitive interest rate from real world businesses. These loans are diversified from traditional lending markets.

Why will Senior Lenders accept a lower interest rate than junior lenders?

Senior lenders don’t have to spend time checking the quality of the loan (this is done for them by junior lenders, who have more to lose)

Their loans are repaid first and automatically diversified across all the lending pools, (a much lower risk than junior lenders)

How Can Goldfinch Outcompete Banks?

Faster

The whole process (loan origination, due diligence, loan issuance to repayment) is fasterdue to use of programmed smart contracts.

Lower-Cost

All stakeholders enjoy lower costs because smart contracts reduce the number of middlemen (vs a bank).

Globally diverse

Goldfinch crowdsources money globally, increasing the speed and diversity of raising money. and Goldfinch allocates money globally, diversifying lenders risk (across the global portfolio of loans).

On chain record-keeping

Borrowers credit history is recorded & publicly available, which helps lenders make better loans (reduce defaults and give more money to productive businesses)

Inclusive

Loans are checked by Lenders who are happy to take higher risk where they have done person due diligence. Secondly, loans are backed by on-chain data to build up accurate credit history on borrowers. These two factors (personal due diligence and on-chain credit history) allows loans to be granted to people previously excluded from loans.

How Can The Interest Rates Be Low For Borrowers And High For Lenders?

Each loan is built using many parts (tranches):

- Senior debt, which has a low interest rate

- Junior debt which has a high interest rate

These tranches are put together in a ratio of 3:1 (3 parts low interest, 1 part high interest). This makes the total interest much lower for the borrower – while still satisfying both Junior & Senior lenders.

An example illustrates

A borrower can afford 10% interest. The loan is made using 4 parts:

- 3 parts Senior debt, with interest of 7%

- 1 part Junior debt, with interest of 19%

When we add these 4 parts together (to make up the loan), we get a composite interest rate of 10%

Liquidity

Junior: limited to loan repayments

Senior: limited to the lesser of new senior-tranche buyers and loan repayments

Conclusion

Goldfinch uses blockchain tech to empowers businesses who were previously excluded or ripped off by expensive loans. Their elegant design aligns all stakeholders. The lending process is inclusive, faster, lower admin costs, globally diverse & have on-chain credit history.